Four years ago we undertook a payment business analysis study of what the possible costs of new regulation and legislation might be for Debit card Interchange swipe fees (2011 Durbin Amendment to Dodd-Frank) and the 2009 CARD Act.

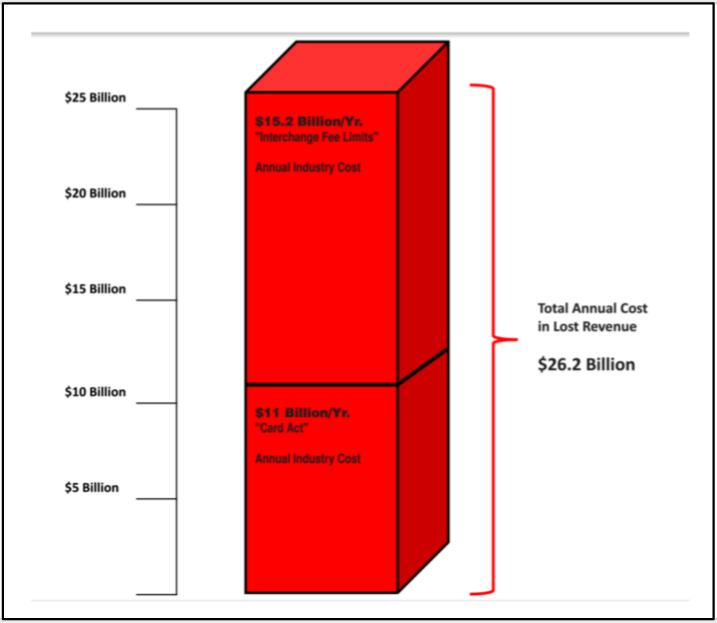

As the chart below shows, our estimate at the time was $26.2 Billion every year in lost revenue for the card industry. That number still seems about right.

Proposed & Actual New Regulatory Cost Impact Per Year

Total annual cost for banks, as forecast by industry analyst, R. K. Hammer:$26.2 Billion/Year

Who will pay for all this? Consumers…in the form of higher fees.

Payment Business Analysis

Don’t get us wrong, we believe that much of what was intended was useful, that card fees needed better more transparent disclosure, what we often coined at the time “The Educational Card Act.” And in the years since enactment, we still believe much of what was intended produced favorable and important consumer education.

There have also been unintended consequences of these regulations and legislation to the payment business.

Our assertion today is that every action (read, Regulation and Legislation) produces an industry reaction (new and higher fees) to offset the cost of compliance with those new rules and regulations. It’s just “Economics 101.”

The jury is still out as to whether or not new card fees will fully offset the annual cost of these regulations – but there already have been and will continue to be new consumer card fees, an financial institutions seek ways to offset the cost of new regulation and legislation.

Some other estimates of new/increased card fees so far are around one-third of what the lost revenue is each year, or $8.6 Billion per year.

That figure will rise in the future since most issuers are going through extensive due diligence on what services are being provide free of charge, and what could be assessed if they chose to do so.

We recognize that some issuers use cards as a cross sell to other important products in their suite of customer services, and therefore may not elect to raise or charge new fees.

Others most certainly will as they treat cards not as a loss-leader but as free-standing profit center. In fact the card business is often the most profitable product at many organizations, in terms of ROA, ROE, and IRR, if not EBIDTA.

That’s the way I see it.

Robert Hammer is Founder and CEO of R.K. Hammer and Card Knowledge factory ®